Close the loop - it's a risk / reward story

sell off or spin off of Packaging business can make the difference

$CLG.AX

MC 13,8M AUD - SP 0,026

Sales 2024: 209M

End 2024 net current assets: -/- 30M AUD

End 2024 net debt: -/- 50M AUD (cash 38M, current borrowings 17M, non current borrowings 71M, of which 38,5M due 26 october 2029)

Two businesses: packaging (mainly Australia) and refurbishing of laptops etc. (biggest partner HP - 3 year contract)

Packaging at average profit per year at about 7M(!)

Net profit 2024: 6,7M AUD

Net profit 2023: 9M AUD

Net profit 2022: 4,6M

Net profit 2021: 4,2M

From the last financial report 24 february 2025 / 1H25 Results Update: "The Close the Loop packaging businesses in Australia and South Africa have performed well, achieving 11% sales growth compared to the previous corresponding period (“pcp”), driven by a focus on winning and onboarding larger clients with global operations. The packaging division has achieved 4% net profit after tax growth on the pcp, with some margin pressure to win new customers and or to retain its existing customer base.”

Temporary (?) problems at refurbishing business:

new facility in Mexico (Mexicali) was delayed (now fully operational)

software virus in april 2025

transition into much broader and more complex space required to significantly upskill it resource base

because of operational problems > higher inventory > negative impact on FCF

Because of operational problems at refurbishing business EBITA this half year expected to be 50% lower than last half year of 2024 (6M versus 12M)

Interest per half year is at about 5M

EBITDA -/- interest last half year: 1M (still positive..)

Proposal Adadmentem November 2024 for $ 0,27 per share (more than 10 times higher than SP today!) > ceased proposal in January 2025

Board / management owns 45% of stocks > aligned

Less than 10% of laptops sold are refurbished > growing opportunity and demand to become more circular

HP has a publicly stated goal of achieving 75% circularity for its products and packaging by 2030

HP contract 3 year (1 November 2023 - 31 October 2026) - already 15 year relationship

The European business launched a pan-European multi-vendor collection program, which resulted in significant interest from all the major print original equipment manufacturers (“OEMs”) with the majority of the OEMs progressively joining the program.

The full financial impact of this collection program is expected to be reflected in the second half of 2025 financial year.

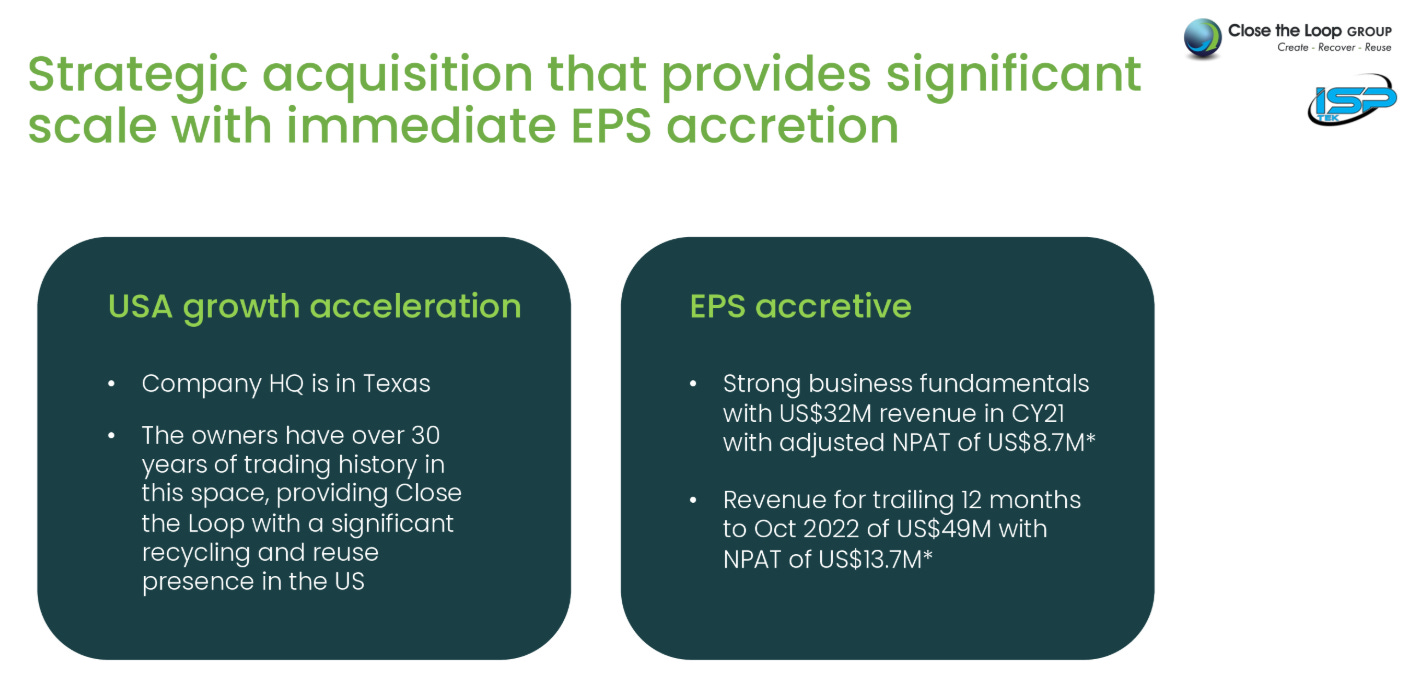

Refurbishing business aquired in 2023 for 99,7M AUD

Net profit refurbishing business 2021 / 2022 at average 17M AUD (almost no interest and no depreciation of goodwill)

Net profit refurbishing business 2023 3,2M - 2024 4,4M

But this is with in 2 years total 13,6M depreciation goodwill and 11,8M finance costs.

So total 32,8M in 2 years without depreciaton and finance cost, so per year 16,4M

Ambition to go on the US stock exchange

Most of their facilities currently have capacity to increase production by the addition of additional shifts, so the company can grow with limited capex in the short term. In most cases, capacity can be doubled or tripled

Negative points:

Communication to investors

A lot of operational problems in the last year(s)

High interest rates

Contract with HP for 3 years - to much dependant on 1 customer

A lot of changes in management (or is this a positive point?)

Positive points:

Normalized profit packaging (7M) + refurbishing (15M before interest and depreciation of goodwill?) = 22M versus EV 63,8M (MC 13,8M +net debt 50M)

A lot of growth opportunities (more OEM (original equipment manufacturers) partners, more geographies, more products, more circular demand etc.)

A lof of capacity to increase production

High insider ownership

Mexicaly facility fully operational

Summary

This company is HATED by the stock market because of all the operational problems in the past(?), bad communication from management and the failed take over from Adamantem.

For now the company is priced for bankruptcy. In my opinion this risk is not high with 38M cash and 17M current borrowings (both end 2024).

Besides that, the packaging business is worth 70M? (10 times 7M profit). So only the sell off or spin off of the packaging business will be enough to pay off all the net debt (88M debt, is mostly in the refurbishing business - net debt is 50M).

This opportunity makes it very interesting for a private equity company.

Base case scenario is a company with 22M profit before depreciation goodwill and interest (packaging 7M + refurbishing 15M) and net debt of 50M. Valuation? 10 * 22M -/- 50M == 170M (SP 0,32) versus MC of 13,8M (SP 0,026) > talking about risk / reward!

Bull case scenario - profit can be a lot higher with all this extra refurbishing capacity to increase production and all this extra sale opportunities in the refurbishing business.